What Is Markethive?

Markethive

is a Market Network, a hybrid: part social network, part marketplace, part SaaS

with a News and Press Release Site built in.

Social Network. An online service or...

Cryptocurrency

/

Crypto News

-

2 days ago

Bitcoin ATMs on The Rise

Since the first Bitcoin automated teller (ATM) was launched in Vancouver, Canada during late-2013, this form of infrastructure has been lauded as a viable medium of global...

Cryptocurrency

/

Crypto News

-

2 days ago

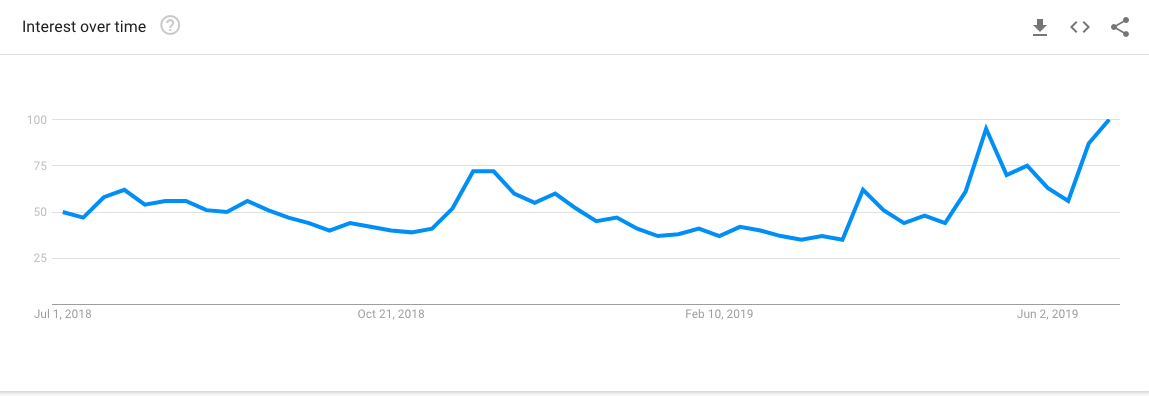

With bitcoin continuing its surging uptrend, crypto bulls like Tom Lee and John McAfee say the altcoin season is bound to make a comeback before the end of the year. Crypto trading has become more efficient with modern technologies. There is a strong connection between artificial intelligence and investing. Trading can be made effective with AI as it helps to find the trading signals at the right time. Therefore, many trading bots have started using AI algorithms.

The Altcoin Season

It’s a w...

Cryptocurrency

/

Crypto News

-

2 days ago

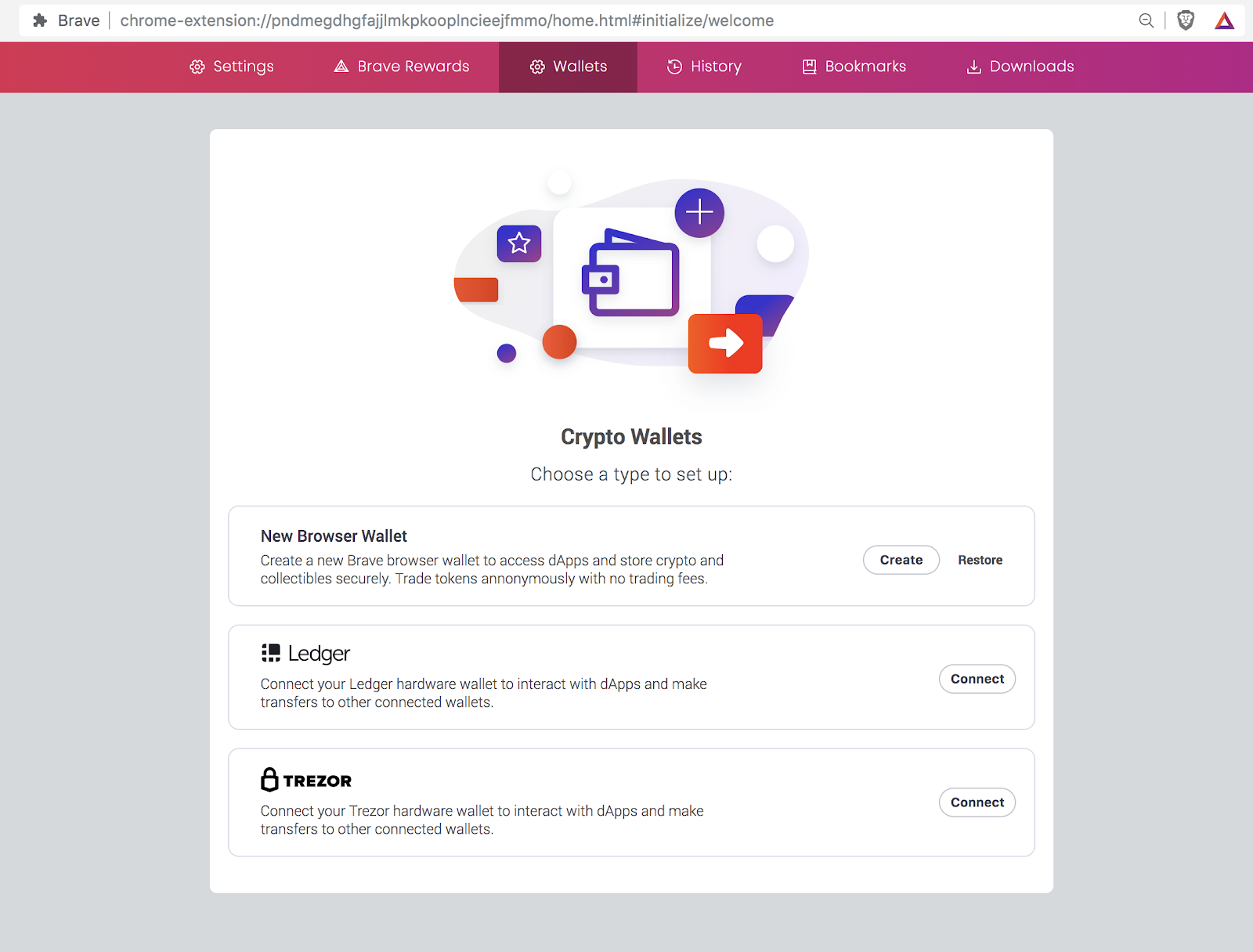

Brave is currently working on integrating an Ethereum, Ledger, and Trezor wallets in their browser, which would allow users to earn and store funds directly into a self-custodied wallet. While the com...

Cryptocurrency

/

Crypto News

-

2 days ago